What about VAT Registration UAE 2026?: Complete FTA Guide for Businesses in Dubai 2026

VAT Registration UAE: Value Added Tax (VAT) is a consumption-based tax applied to most goods and services , including Dubai. Since its introduction in 2018, VAT registration has become mandatory for businesses meeting specific turnover thresholds. The Federal Tax Authority (FTA) oversees VAT compliance, and registering with them ensures your business operates legally while avoiding hefty penalties. Our tax experts at The VAT Consultant have successfully helped over 500 businesses navigate the VAT registration process in Dubai, ensuring seamless compliance and operational efficiency.

What is VAT Registration in Dubai?

VAT registration in Dubai is the official process of enrolling your business with the Federal Tax Authority to collect, report, and remit VAT on taxable supplies.

Key Benefits:

● Receive a Tax Registration Number (TRN) for official documentation

● Charge VAT on your sales legally

● Claim input tax credits on purchases

● Remit only net VAT liability to the FTA

The registration process is conducted entirely online through the FTA portal and involves submitting business documentation, financial records, and ownership details. VAT registration enhances your business credibility with customers, suppliers, and financial institutions.

Who Needs to Register for VAT in Dubai?

VAT registration in UAE follows specific turnover thresholds:

Mandatory Registration:

● Annual taxable supplies or expenses exceeding AED 375,000

● Must register within 30 days of crossing this threshold

Voluntary Registration:

● Annual taxable supplies or expenses between AED 187,500 and AED 375,000

● Allows businesses to reclaim input VAT

Business Types Affected:

● Retail stores and restaurants

● E-commerce platforms

● Professional service providers (consultants, lawyers)

● Manufacturing companies

● Import-export businesses

● Freelancers and sole proprietors

Step-by-Step VAT Registration Process?

The VAT registration process typically takes between two to four weeks:

Step 1: Prepare Required Documents

● Gather trade license, Emirates ID, and passport copies

● Collect financial statements and bank account details

● Ensure all documents are current and accurate

Step 2: Create FTA Account

● Visit the FTA e-Services portal

● Create account using your email address

● Verify email and set up security credentials

Step 3: Submit Registration Application

● Complete online VAT registration form

● Provide accurate business and ownership information

● Upload supporting documents

● Double-check all entries before submission

Step 4: Verification and TRN Issuance

● FTA reviews application within 20 business days

● Receive TRN via email upon approval

● Download VAT registration certificate from FTA account

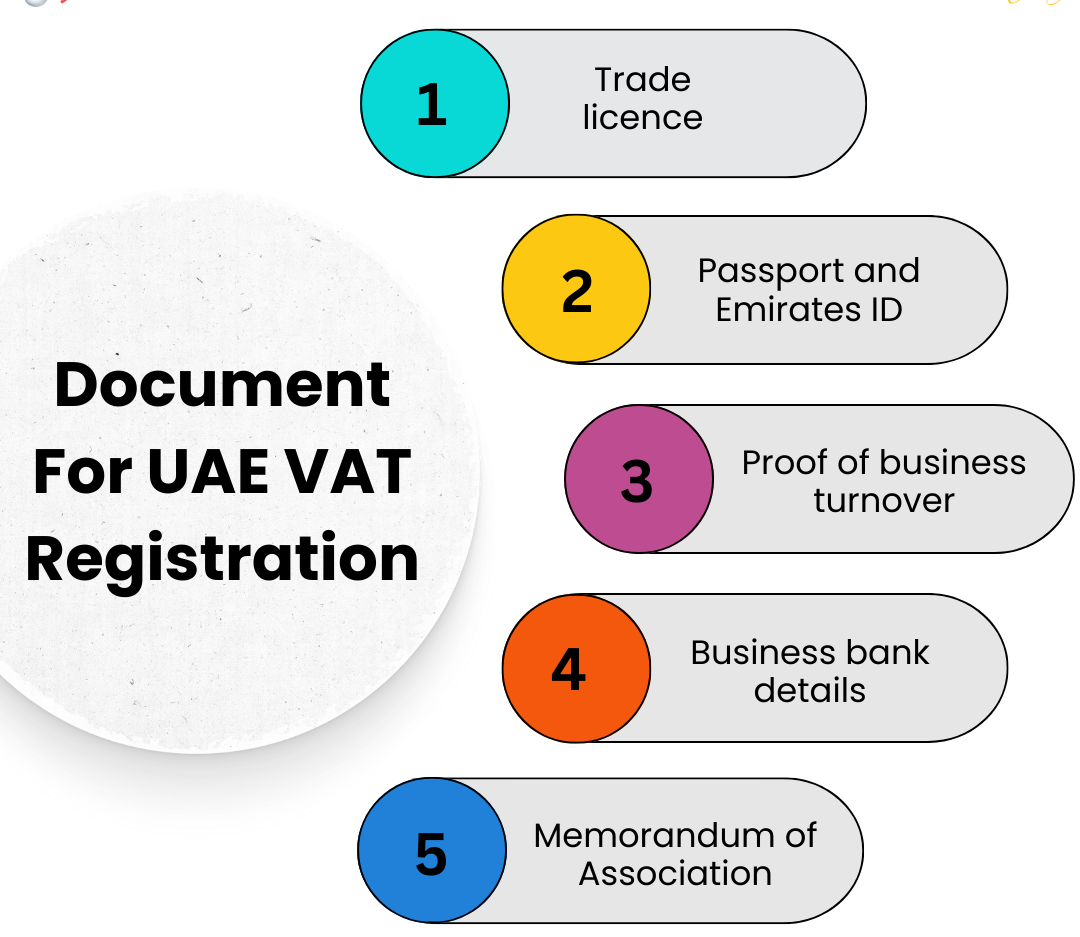

Documents Required for VAT Registration

Essential Documents:

● Valid trade license (DED or free zone authority)

● Emirates ID and passport copies for all owners/partners/signatories

● Financial statements (audited)

● Bank statements (past 12 months)

● Revenue reports demonstrating turnover

● Sales invoices and purchase records

Additional Documents (if applicable):

● Tenancy contracts for business premises

● Memorandum of association (for companies)

● Partnership deeds

● Customs registration certificates (for import-export)

Common Mistakes to Avoid

Delaying Registration

● Penalties start at AED 10,000 for late registration

● Register within 30 days of exceeding AED 375,000 turnover

Incorrect Information

● Providing inaccurate business or financial data causes rejection

● Verify all details match official documents

Missing Documents

● Incomplete applications are automatically rejected

● Create a checklist and upload all required files

Wrong Business Classification

● Incorrect activity codes affect VAT treatment

● Consult tax professionals for proper classification

Ignoring Deadlines

● Missing the 20-day response window cancels your application

● Requires restarting the entire process

Benefits of Registering for VAT in Dubai

Legal Compliance

● Meet UAE tax laws and avoid penalties (AED 10,000 to AED 15,000)

Improved Credibility

● Enhanced reputation with corporate clients and government entities

● Preferred supplier status with large companies

Business Growth Opportunities

● Access to government tenders and contracts

● Reclaim input VAT on business expenses

● Improved cash flow management

Competitive Advantage

● Professional and established business image

● Attract quality customers and partnerships

Why Choose Taxoryx Accounting & Bookkeeping Services LLC?

At Taxoryx, we are a team of qualified CAs, CPAs, and ACMA professionals dedicated to providing accurate, reliable, and timely transfer pricing services. Our services include:

- Transfer pricing studies and reports

- Comparable analysis

- Method selection guidance

- Master file and local file preparation

- Corporate tax compliance support

Ensure your UAE business remains fully compliant and tax-efficient with our expert guidance.